Tokenomics

In the next few sections, we will cover the tokenomics of the CognideX Token. We will discuss the distribution of tokens, the use cases of the token, and the governance structure of the CognideX ecosystem.

CGDX Token Utility

Medium of Exchange

CGDX is used as a medium of exchange within the CognideX platform to pay for data, services, and products.

Incentives

Users can receive CGDX for:

- Contributing data to data pools

- Staking CGDX tokens against data pools for recurring rewards

- Analyzing data pools and providing insights

- Merging data pools to create larger sets

- Listing data on the CognideX marketplace

- Participating in platform governance

Governance

CGDX holders can:

- Vote on proposals like protocol upgrades and fee changes

- Propose protocol and ecosystem changes

- Participate in community discussions

- Validate data quality and make related decisions

- Govern data pools and the marketplace

- Manage the CognideX treasury

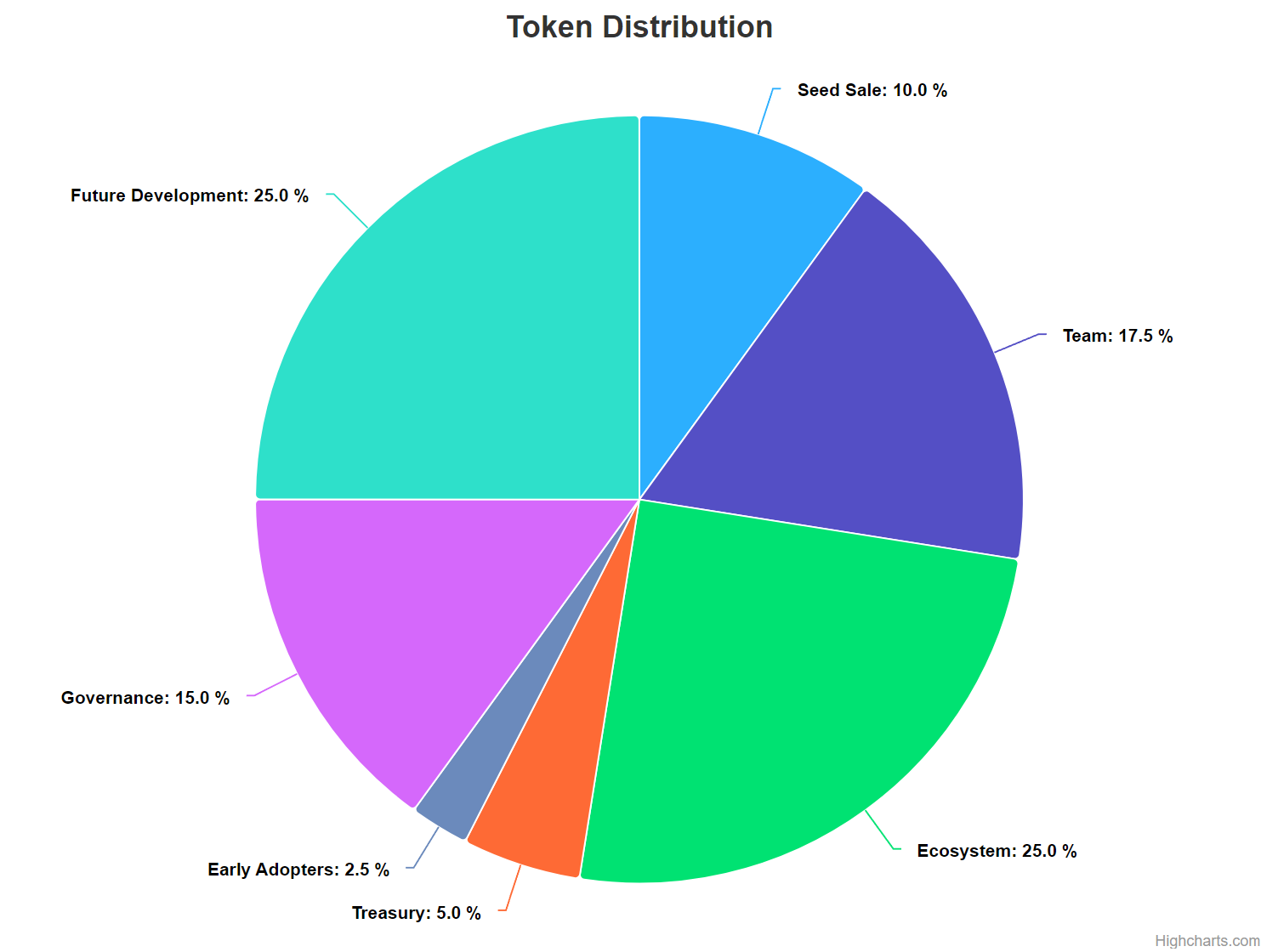

Token Distribution

| Category | Subcategory | Percentage |

|---|---|---|

| Seed Sale | 10% | |

| Private Sale | 7% | |

| Public Sale | 3% | |

| Team | 17.5% | |

| Founders | 4.5% | |

| Advisors | 2% | |

| Team | 6% | |

| Open Source Developers | 5% | |

| Ecosystem | 25% | |

| Data Contributors | 17.5% | |

| Data Consumers | 5% | |

| Data Analysts | 2.5% | |

| Treasury | 5% | |

| Early Adopters | 2.5% | |

| Governance | 15% | |

| Marketing | 5% | |

| Community Development | 5% | |

| Governance Participation | 5% | |

| Future Development | 25% |

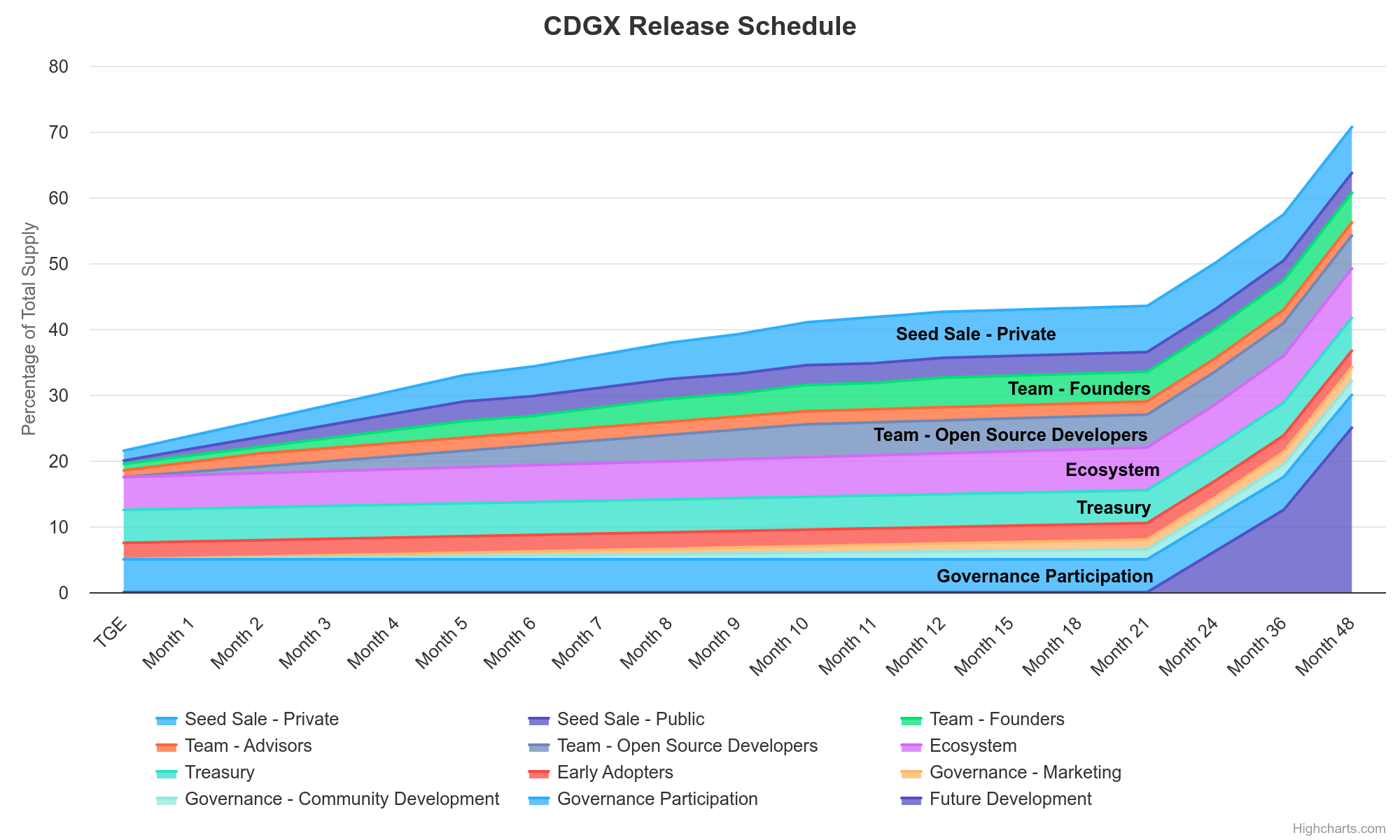

Token Release Schedule

Seed Sale: 10% at TGE

-

Private Sale: 7% with a 12-month vesting period.

- Release Schedule: 1.5% at TGE, 0.5% monthly for 11 months.

-

Public Sale: 3% with a 6-month vesting period.

- Release Schedule: 0.5% at TGE, 0.5% monthly for 5 months.

Team: 17.5% with a 2-year vesting period

-

Founders: 4.5%

- Release Schedule: 1% at TGE, 0.5% monthly for 3 months, 0.5% quarterly for 4 quarters.

-

Advisors: 2% with a 1-year vesting period.

- Release Schedule: 1% at TGE, 0.5% monthly for 2 months.

-

Open Source Developers: 5%

- Release Schedule: 0 at TGE, 1% spread over 12 months, KPI based.

Ecosystem: 5% at TGE, 5% released over 4 years

Incentives for data pool contributors and analysts.

Treasury: 5% at TGE

Used to fund platform development and growth.

Early Adopters: 2.5% at TGE with a 6-month vesting period

- Incentives for early users and supporters.

- Bonus: First 10,000 users receive 100 CGDX each, with tokens locked for 6 months.

Governance: 15% with a 4-year vesting period

-

Marketing: 5%

- Release Schedule: 0 at TGE, 1% spread over 12 months, 4% KPI-based.

-

Community Development: 5%

- Release Schedule: 0 at TGE, 1% spread over 12 months, 4% KPI-based.

-

Governance Participation: 5% at TGE.

Future Development: 25% with a 4-year vesting period

Funding for future development and new features on Polkadot and other blockchains.